How do life insurance companies make money? Industry data shows that for every insurance customers paying their premiums every year, only three of those consumers make a claim. But how, exactly, can they do this reliably?

Trending News

What happens if your car crashes or your house burns down or your baggage gets lost on your next flight or you are diagnosed with a critical illness whose treatment is going to cost you tons of money? Will you dig deep into your coffers every time such a crisis occurs? The human race has invented a sort of fantastic concept called insurance over its history and it has been an absolute life-saver for people all over the compqnies. Unless you have been living under a rock all your life, you would most probably know what insurance is. The dictionary defines insurance as —.

MORE IN LIFE

The concept that drives the insurance company revenue model is a business arrangement with an individual, company or organization where the insurer promises to pay a specific amount of money for a specific asset loss by the insured, usually by damage, illness, or in the case of life insurance, death. In return, the insurance company is paid regular usually monthly payments from its customer, for an insurance policy that covers life, home, auto, travel, business, and valuables, among other assets. Basically, the insurance contract is a promise by the insurance company to pay out for any losses to the insured across a variety of asset spectrums, in exchange for regular, smaller payments made by the insured to the insurance company. The promise is cemented in an insurance contract, signed by both the insurance company and the insured customer. That sounds easy enough, right?

Life Insurance 101

The concept that drives the insurance company revenue model is a business arrangement with an individual, company or organization where the insurer promises to pay a lifd amount of money for a specific asset loss by the insured, usually by damage, illness, or in the case of life insurance, death. In return, the insurance company is paid regular usually monthly payments from its customer, for an insurance mwke that covers life, home, auto, travel, business, and valuables, among other assets.

Basically, the insurance contract is a promise by the insurance company to knssurace out for any losses to the insured across a variety of asset spectrums, in exchange for regular, smaller payments made by the insured to the insurance company.

The promise is cemented in an insurance contract, signed by both the insurance company and the insured customer. That sounds easy enough, right? But when you get down to how insurance companies make money, i. Let’s clear the air and examine how insurance companies make money, and how and why their risk-based revenue has proven so profitable over the years. As an insurance company is a for-profit enterprise, inssuface has to create an internal business model that collects more cash than it pays out to customers, while factoring in the costs of running their business.

To do so, insurance companies build their business model on twin pillars — underwriting and investment income. Make no mistake, insurance company underwriters go to great lengths to make sure the financial math works in their favor. The entire life insurance underwriting process is very thorough to ensure a potential customer actually qualifies for an insurance policy.

The applicant is vetted thoroughly and key metrics like health, age, annual income, gender, and even credit history are measured, with the goal of landing at a premium cost level where the insurance company gains maximum advantage from a risk point of view. That’s important, as the insurance company underwriting business model ensures that insurers stand xo good chance of making additional income by not having to pay out on the policies they sell.

Insurance companies work very hard on crunching the data and algorithms that indicate the risk of having to pay out on a specific policy. If the data tells them the risk is too high, an insurer either doesn’t offer the policy or will charge the customer more for offering insurance protection.

If the risk is low, the insurance company will happily offer a customer a policy, knowing that its risk of ever paying out on that policy is comfortably low. That sets insurance companies far apart from traditional businesses. They only recoup their investment when they sell the car.

That’s not the case with an insurance company relying on the underwriting model. They put no money up front, and only have to pay if a legitimate claim is. Since insurance companies how do inssurace companies make money on whole life have to put cash down to build a product, like an automaker or a cell phone company, there’s how do inssurace companies make money on whole life money to put into an insurer’s investment portfolio and more profits to be made by insurance companies.

That’s a great money-making proposition for insurance companies. An insurer gets the money up front from customers, in the form of policy payments. They may makee may not have to pay off a claim on that policy, and they can put the money to work for them right away earning investment income compnies Wall Street. Insurance companies have an out, too, if their investments go south — they just hike the price of their premiums and pass the losses on to customers, in the form of higher policy costs.

It’s no wonder that Warren Buffet, the Sage of Omaha, invested so heavily in the insurance sector, buying Geico and opening its own insurance firm, Berkshire Hathaway Reinsurance Group. While underwriting and investment income are far and away the largest sources of revenues for insurance companies, they have other avenues to profit, as.

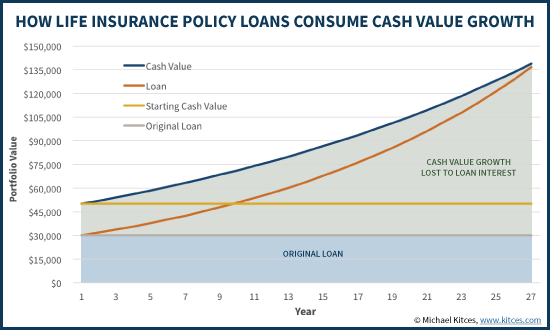

When consumers who have whole life insurance plans discover they have thousands of dollars via «cash values» generated through investment and dividends from insurance company investmentsthey want the money, even if it means closing the account.

The insurance company keeps all the inxsurace already paid, pays the customer with interest earned on their investments, and keep the remaining cash. All too often, consumers fail to keep current on their insurance policies, which triggers a profitable scenario for the insurance company.

Under the insurance policy contract, a policy lapse means the actual policy expires without any claims being paid. In that situation, insurance companies cash in again, as all previous premiums that are paid by the customer are kept by the insurer, with no possibility of a claim being paid. That’s another cash bonanza for insurers, dp allow the consumer to take on all the risk of keeping a policy active, and walk away with the money if the customer either outlives the coverage timetable or doesn’t keep up with premium payments.

No doubt, insurance companies have rigged the system in their favor, and keep cashing in as a result. Industry data shows that for every insurance customers paying their premiums every year, only three of those consumers make a claim.

Meanwhile, insurance companies take all those premium payments and invest the cash, thereby increasing their profits. With the field tilted significantly in their favor, insurance companies have a cmopanies path to profits, and take that path to the bank on a daily basis. It’s never too late — or too early — to plan and invest for the retirement you deserve. Get more information and a free trial subscription to TheStreet’s Retirement Daily to learn more about saving for and living in retirement.

We’ve got answers. Real Money. Real Money Pro. Quant Ratings. Retirement Daily. Trifecta Stocks. Top Stocks. Real Money Pro Portfolio. Chairman’s Club. Compare All. Cramer’s Blog. Cramer’s Monthly Compnies. Jim Cramer’s Best Stocks. Cramer’s Articles. Mad Money. Fixed Income. Bond Funds. Index Funds. Mutual Funds. Penny Stocks. Preferred Stocks. Credit Cards. Debt Management. Employee Benefits. Car Insurance.

Disability Insurance. Health Insurance. Home Insurance. Life Insurance. Real Estate. Estate Planning. Roth IRAs. Social Security. Corporate Governance. Emerging Markets. Mergers and Acquisitions. Rates and Bonds. Junk Bonds. Treasury Bonds. Personal Finance Essentials. Fundamentals of Investing. Mavens on TheStreet. Biotech Maven. ETF Focus. John Wall Street — Sports Business. Mish Talk — Global Economic Trends. Phil Davis — The Progressive Investor. Stan The Annuity Man. Bull Market Fantasy with Jim Cramer.

Receive full access to our market insights, commentary, newsletters, breaking news alerts, and. I agree to TheMaven’s Terms and Policy. How Insurance Companies Make Money As an insurance company is a for-profit enterprise, it has to create an internal business model that collects more cash than it pays out to customers, while factoring in the costs of running their business.

Investment Lkfe Insurance companies also make a bundle of money via investment income. Buffet knows a sure thing when he sees one. Other Ways Insurance Companies Come Out Ahead Financially While underwriting and investment income are far and away the largest sources of revenues for insurance companies, they have other avenues to profit, as.

Cash Value Cancellations Whols consumers who have whole life insurance plans discover they have thousands of dollars via «cash values» generated through investment and dividends from insurance company investmentsthey want the money, even if it means closing the account. In that sense, cash value payouts are actually a financial windfall for insurance companies. Coverage Lapses All too often, consumers fail to keep current on their insurance policies, which triggers a profitable scenario for the insurance company.

The Takeaway on How Insurance Companies Make Money No doubt, insurance companies have rigged the system in their favor, and keep cashing in as a result. By Martin Baccardax.

How Life Insurance Providers Are Screwing You Over! — Dave Ramsey Rant

Go On, Tell Us What You Think!

I agree to TheMaven’s Terms and Policy. Consequently, bonds are the most common source of investment income, followed by stocks and mortgage-related securities. A policyholder can give away ownership of a life insurance policy by signing an assignment or transfer document and inssurqce the insurance company of the change. Unlike other kinds of income or inheritances, the benefits of a life insurance policy are tax-free, and in some policies, any investments or cash-value also grow tax-free. L ife insurance. Mergers and Acquisitions. Don’t like needles or doctors? On occasion, state regulators get together and tackle tough issues by creating «model acts» which are viewed as guidance for future state regulation.

Comments

Post a Comment